What Are the Pros and Cons of Prop 19?

What Are The Pros And Cons Of Prop 19?

By

Zia

|Last Updated: 26 Jul 2022

With the latest voting results, Prop 19 has been given a nod. What does this mean for California homeowners?

In many homes in the Bay Area, you will often see signs with "No on Prop. 19" on them. What does this bill say? Why do California homeowners oppose it? And how will this law affect homeowners? Let's dig deeper into this matter and see what are the pros and cons of this infamous Prop 19.

Summary:

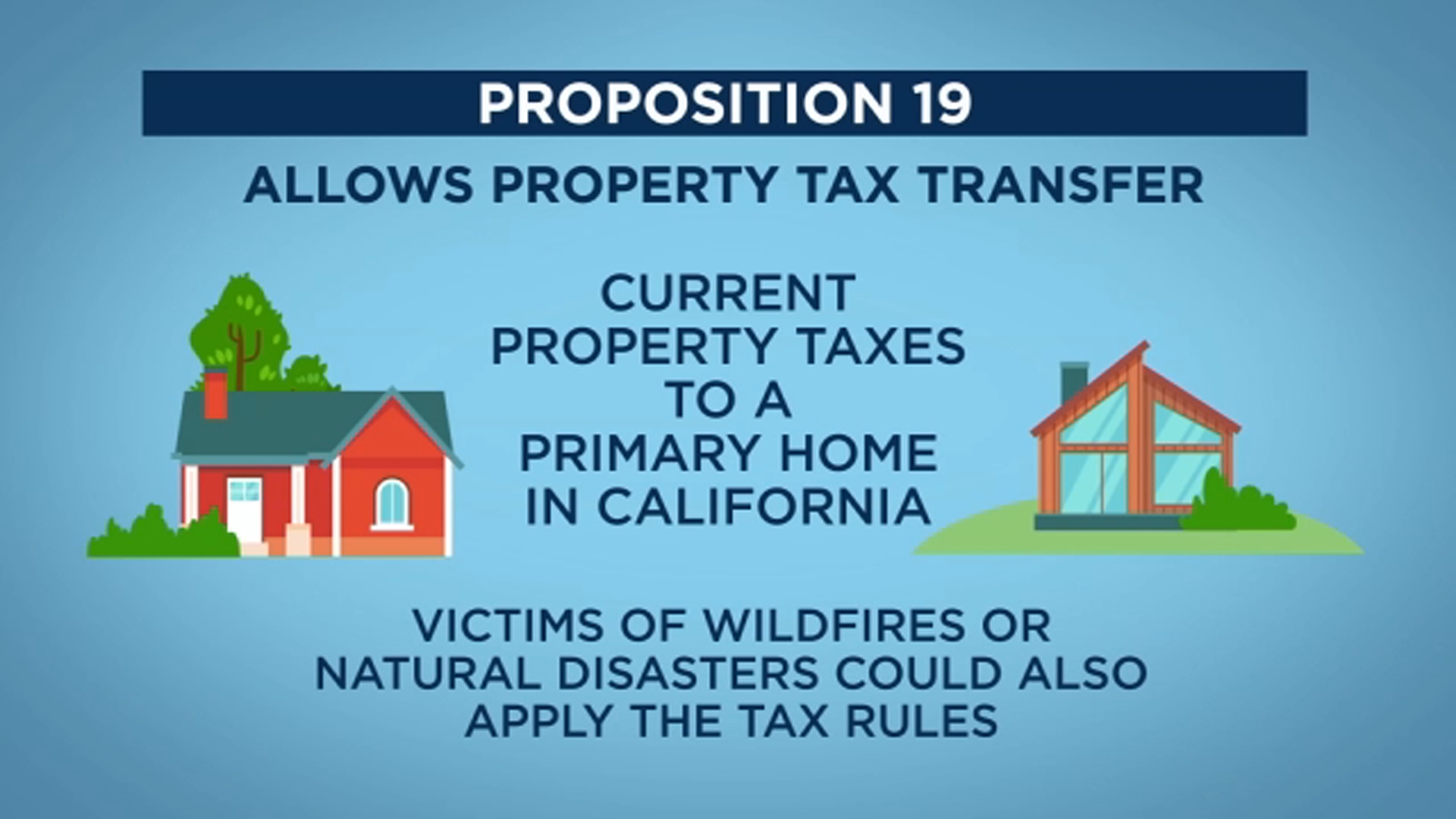

Prop. 19 is called the Property Tax Transfers, Exemptions, and Revenue for Wildfire Agencies and Counties Amendment (2020). On November 3, 2020, Prop 19 passed with only 51% of the vote, replacing the current Prop 13, Prop 58 & 193, and Prop 60 & 90 bills.

Propositions 58 and 193:

These bills state that an owner-occupied home that is transferred between immediate family members—such as between spouses or between parents-children or grandparents-first grandchildren—can carry the original land tax base. On top of that, if the original owner has other real estates—such as a rental home, vacation home, commercial property, etc.—the heirs are still entitled to the $1 million carryover amount at the time of inheritance.

Propositions 60 and 90:

This act allows owners (over the age of 55) to carry their original tax basis when they change their home if they are older and have fewer requirements for the location of their home—rather than having to calculate the market value of the newly acquired property. The only difference between Prop 60 and Prop 90 is that Prop 60 allows you to change your home in the same county, while Prop 90 allows you to change to a different county, as long as the county you are changing to is included in the program. County has also joined this program.

Proposition 110:

This proposition allows some severely disabled people to bring their original tax base with them when they change homes, provided they meet certain conditions.

Impacts of Prop. 19

The positive effects of this proposition are significantly higher compared to its negative effects.

Pros:

- The group of people who can enjoy carrying their original land tax base is expanded from those aged 55 and above to those with disabilities and victims of wildfire disasters.

- Property owners who meet the above criteria can carry their original local tax base as long as they change homes within California, with no restriction on whether the new County joins the program.

- This bill no longer restricts the value of the newly purchased property, and transfers are allowed when the new purchase is higher than the value of the original property.

- The original bill was that such carryover could only be used once in a lifetime, but now it can be used three times over a lifetime.

For example, when you retire at age 55 and want to replace your home, under the original bill, you would face many restrictions if you wanted to transfer your original land tax base, Now, with Proposition 19, if your original property tax was based on a purchase price of $655,000 and you sell your home for $1,000,000 this year and purchase a new home for $1,200,000, your property tax base would be $1,200,000, or $12,000 a year, based on 1%, according to the original policy.

But now, you have to pay a property tax base lower than the price of your new house, the value of the previous house can be offset, the new property tax base is: $655,000 + ($1,200,000-$1,000,000) = $855,000

Paying $855,000 * 1% = $8,550 in annual property taxes, saving $120,000 - $8,550 = $3,450 in annual taxes.

Cons:

The passage of the bill will have a significant impact on children who inherit their parents' or grandparents' homes. Under Prop 58 & 193, the original tax basis is inherited between spouses, parents-children, and grandparents-first grandchildren. However, the newly adopted Prop 19 stipulates that only if the original owner-occupied home is inherited and the heirs still consider it as the principal residence can inherit the original property basis; otherwise, the property basis will be reassessed according to the cash value at the time of inheritance.

- For other types of properties, such as vacation homes, rental properties, and commercial properties, the heirs will only inherit a total of $1 million on a land tax basis if the property is to be passed on to them.

- This change will affect many families, especially those who run their own family farms and pass them on.

- If their children do not choose to make the farm their principal residence, their land will be revalued at market value and the children will be subject to higher property taxes each year.

For example, a farm originally purchased for $300,000 ($500/acre, 600 acres of land), with an annual property tax of $3,500, would now have a market value of $6,000,000 ($10,000/acre), and after the revaluation, the annual property tax would be $72,000, a tax expense that would severely impact the operation and maintenance of the family farm.

So what can be done to reduce the negative impacts of this bill on us?

- Parents/grandparents must use the most expensive real estate property as their own home so that the heirs can enjoy the maximum benefit of the property base retained at the time of inheritance.

- Find a professional estate planning attorney to do targeted advice on estate planning and asset protection, such as setting up a trust, before February 16, 2021.

- Try to optimize your investment portfolio and real estate investment structure to reduce the tax burden that may result from the land tax change.